By Kevin Farfan, Realtor® | I Sell Lifestyles! | www.kevinfarfan.com

🇺🇸 A New Spending Era: “One Big Beautiful Bill” and Its Real Estate Ripples

On July 4, 2025, President Donald Trump signed into law the “One Big Beautiful Bill”—a sweeping tax and spending package that will touch nearly every corner of the U.S. economy. For those of us in real estate, especially here in Tampa Bay, this legislation brings both opportunities and challenges.

If you’re a buyer, seller, or investor, here’s a detailed breakdown of how this bill may shape the Tampa housing market over the next 6–18 months.

💸 Key Features of the Bill (In Simple Terms)

-

Tax Extensions: Continues Trump-era tax cuts, benefiting high earners and businesses.

-

SALT Cap Raised: Deduction cap for state/local taxes increased to $40,000, especially helpful in high-tax states.

-

Deductions for Workers: Tax breaks for tipped workers and overtime earners.

-

Spending Cuts: Major reductions to Medicaid, housing assistance (HUD), and SNAP (food stamps).

-

Deficit Increase: Estimated to add $2.8–$3.4 trillion to the national debt over 10 years.

🏠 How This Affects Real Estate in Tampa Bay

Let’s break it down by category:

📉 1. Mortgage Rates: Pressure Is Building

Why it matters: Higher federal debt typically pushes up interest rates.

-

Result: We’re likely to see 30-year fixed mortgage rates climb past 7% again.

-

Impact in Tampa: First-time homebuyers and FHA borrowers could be priced out or forced into smaller homes.

Kevin’s Tip: If you’re thinking of buying, lock your rate soon—especially if you qualify for builder incentives or down-payment assistance.

💰 2. Luxury & High-End Market: A Hidden Boost

-

Wealthier buyers will benefit from the extended tax cuts and raised SALT cap.

-

Developers may ramp up luxury new construction, especially in South Tampa, Davis Islands, and Tierra Verde.

Kevin’s Insight: This segment may remain strong. If you’re a seller in the luxury range, now may be your moment to list.

🧱 3. Construction Costs: Tariffs & Red Tape Relief

-

The bill proposes to ease housing-related regulations, potentially making building faster and easier.

-

However, new tariffs on imported materials could add $15K–$25K to the average cost of a new home.

Tampa Forecast: Builders in Pasco and Manatee counties may still benefit from faster permitting, but material costs may raise prices for consumers.

🧍 4. Rental Market & Affordability: A Growing Crisis

-

Section 8 and HUD funding slashed by over 40%.

-

Local families relying on rental assistance may face evictions or longer waitlists.

-

Affordable housing projects in Tampa Bay may see delays or cancellations due to reduced funding.

Kevin’s Concern: We may see an increase in rental demand with tighter supply, especially in Brandon, Temple Terrace, and Pinellas Park.

📊 5. Investor Opportunities: A Two-Sided Coin

Pros:

-

Strong rental demand could lead to higher rental yields.

-

Cash investors may dominate the low-end market as first-time buyers drop out.

Cons:

-

Rising rates mean financing will cost more.

-

Investors using leverage may see tighter cash flow margins.

Investor Tip from Kevin: Now is a smart time to look at build-to-rent or 1031 Exchange properties in appreciating corridors like Wesley Chapel and Riverview.

🛡️ What You Can Do

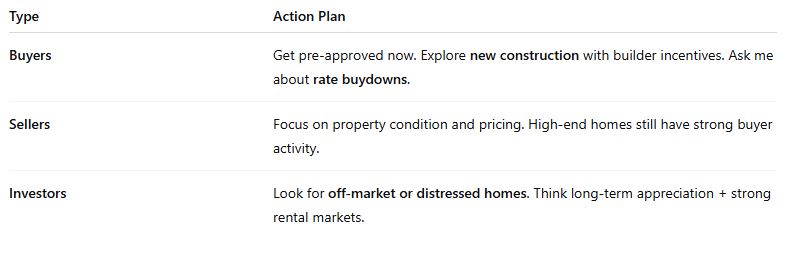

Whether you’re a buyer, seller, or investor, here’s how to prepare:

🌴 Kevin’s Final Word

The Tampa Bay market is still one of the most resilient and in-demand markets in the U.S. But smart decision-making is key. The new federal spending package will favor the prepared, and now more than ever, it’s important to have a knowledgeable Realtor on your side.

Whether you’re buying your first home, investing in rental property, or selling at the top of the market, I’m here to help you navigate with clarity and confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link